This article reflects the opinion and analysis as well as information collated by AE Research Management Sdn Bhd, and does not constitute an investment advice or recommendation

The pharmaceutical industry is undergoing an impressive transformation, driven by breakthroughs in new modalities, such as antibody drug conjugates (ADCs), RNA interference therapeutics, CAR T-cell therapies and gene therapies.

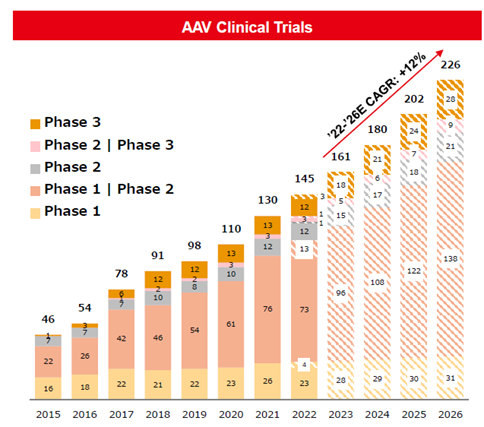

Among those, viral vector-based gene therapy has received enormous global attention due to its broad applicability and its potential to become a one-time treatment. The first successful gene therapy was approved by the US FDA in 2017 to treat an inherited retinal disorder, followed by 7 other approvals between 2019 and 2023. And there are over 2,000 gene therapies in development including about 161 in various stages of clinical trials today (chart below).

Source: Ajinomoto Inc

Despite the approval of numerous life-changing gene therapies, there exists a sizable gap between development and manufacturing capabilities, a topic not often discussed. In fact, the industry is still in its infancy with limited understanding on virus assembly, lack of efficient production process and the lack of proper analytical tools, which all needs to be resolved before gene therapy can enter commercial scale.

Manufacturing Challenges

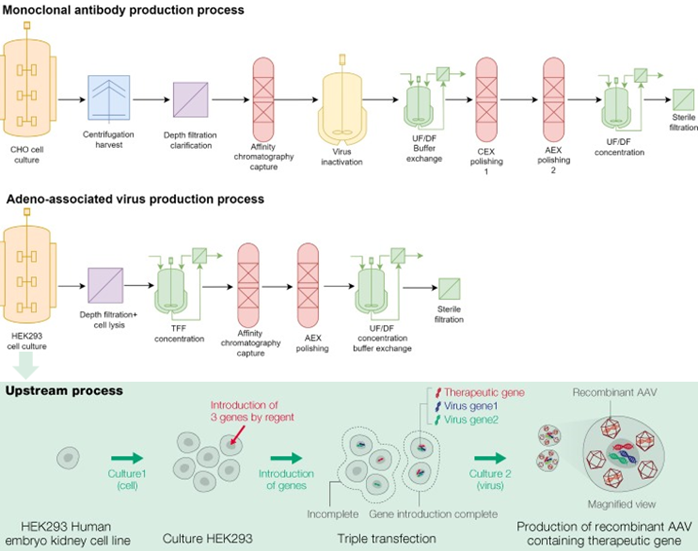

The production of gene therapy and antibody rely on a similar synthesis process, a biochemical-based process that uses cell culture. However, the process is far more complex for gene therapy, partly because viral vectors, which is one of the key components of gene therapy, are produced intracellularly (within the cell) while antibodies are produced extracellularly.

Source: Trends in Biotechnology (Fujifilm)

The current process of creating viral vectors, known as triple transfection, has extremely low yield where only 5%-30% of the viral capsids contain the therapeutic element. The empty and full capsids are similar in size and charge, making the separation process extremely difficult. Besides, cell lysis is needed to extract viral vectors, but it releases large amount of residual cell components, which pose a significant risk as it could trigger immune response in the human body. A combination of multiple factors has made purification far more complicated and costly than that of antibodies.

Lack of Analytics

Unlike antibodies where the product is a major component of the fermentation broth, the contaminant-to-product ratio is 1,000 times less favorable in gene therapy. The greatest challenge today is the lack of high-throughput analytics that could enable in-process control. Some of the commonly used assays are complex, require manual sampling and take days for evaluation, while other methods might take up to months, depending on the provider’s available capacity.

Viral Vector Variability

Viral vectors come in different serotypes, each with different tissue tropism (infects different types of cells). For example, AAV, the most used viral vector, exists in 12 serotypes. Although this has largely expanded the scope of treatment, such diversity complicates process development, especially the purification process which varies not only depending on the serotypes but also vector design, transgene sequence and cell line. As of now, the industry still lacks adequate knowledge and process methods to accommodate all variations. Due to the lack of standardized approach, the current manufacturing is largely manual, labor intensive and often requires highly trained and over-qualified talents to operate the production.

Scalability

Today, most of the viral vector production are performed by gene therapy developers at a small scale (laboratory scale). Such methods provide sufficient quantities for ultra-rare or tissue-specific diseases such as retinal disorders. However, these processes are not suitable for scale-up, thus making it almost impossible to supply systemic disorders beyond phase 1 trials (e.g Hemophilia, Duchene Muscular Dystrophy).

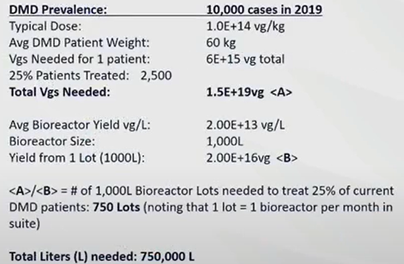

Since most gene therapy frontrunners are small biotech companies, it becomes more cost-effective and efficient to outsource and to leverage on the expertise of CDMOs. CDMOs have been operating commercial scale production up to 2,000L and have recently succeeded in scaling up to 5,000L. However, it was reported that the current process could only yield 3 doses of DMD treatment per 1,000L batch per month, and 750,000L of capacity is needed to supply 10,000 patients.

Source: Forge Biologics

Pricing and Reimbursement

As more gene therapy products enter the market, their price has raised huge concern among payors and governments. The once a lifetime treatment is priced between $1 million to $4 million, justified by their superior clinical benefits, high development and manufacturing cost, and limited patient population. In the past few years, several gene therapies were withdrawn from the EU market due to pricing conflicts. Going forward, developers will likely move towards larger patient populations to lower the average price, which will eventually place further pressure on the production line.

In conclusion, at this point of time, having the technical knowhows to optimize and streamline gene therapy production becomes far more crucial than expanding production capacity.