This article reflects the opinion and analysis as well as information collated by AE Research Management Sdn Bhd, and does not constitute an investment advice or recommendation

Japan’s pharmaceutical industry was once a world leader in the 1980s, producing nearly 30% of the world’s new chemical drugs. Today, despite being the 3rd largest pharmaceutical market, it has become much less appealing to investors due to the government’s stringent drug control policies. Although the country’s biannual drug price revision was proven successful in curbing rising health care costs, it was detrimental to the Japanese startups as it became almost impossible to recoup their R&D costs and thus made it even difficult to secure investors’ funding.

This has resulted in a unique phenomenon where development of innovative drugs was mainly led by large pharmaceutical companies which is a huge contrast to the U.S where majority of the phase 3 candidates are from small companies.

Superior Capabilities in Complex Biologics.

Many large Japanese players possess clinically proven world-class technologies but are often overshadowed by the potential biotech breakthroughs that top headlines repeatedly. Unlike the US which has been investing in exciting modern biotechnologies such as genomics, proteomics and bioinformatics, Japanese firms have been striving in the design and production of complex biologics thanks to the strong chemical synthesis and bioprocess fundamentals which they accumulated through their chemical, textile and brewery industry.

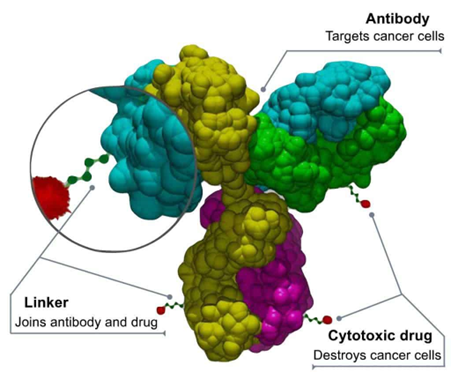

For example, Daiichi Sankyo managed to surprise the world with its success in ADC (antibody drug conjugate) development, a new therapeutic modality that combines antibody with a cytotoxic payload via a tumor selective cleavable linker (refer figure). Daiichi’s ADC technology has changed the paradigm of immunotherapy after the multibillion-dollar drug, Enhertu was proven far more effective in treating HER2-positive breast cancer, an aggressive cancer subtype with poor outcomes and high mortality rates. Apart from Enhertu, the company is now running clinical trials for 3 other ADC drugs that target various hard-to-treat cancer subtypes.

Source: Daiichi Sankyo

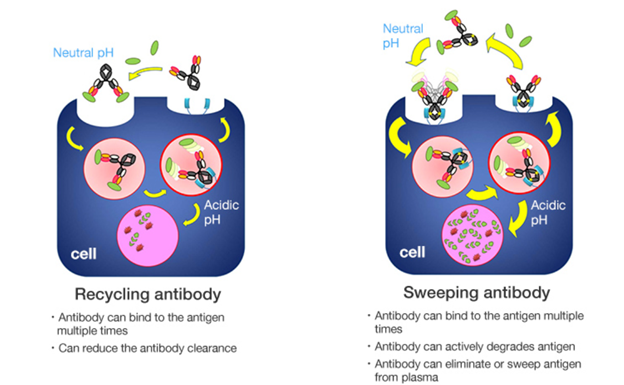

Another example is Chugai Pharmaceutical, a global pioneer in monoclonal and bispecific antibody equipped with revolutionary antibody engineering capabilities. Not many would know that Chugai was the second to launch a bispecific antibody globally, a technology mastered by a limited number of companies including Amgen, Janssen Pharmaceuticals, Roche and Genmab. Chugai is also known for its unique ‘Recycling Antibody’ and ‘Sweeping Antibody’ technology, which allows the elimination of unwanted antigens and recycles the antibody for multiple binding. Such technology creates a strong competitive advantage for Chugai’s antibody because it allows for significant improvement in drug efficacy and prolonged dosing intervals.

Source: Chugai Pharmaceutical

Hidden Gems to Benefit from Supportive Policies

Industry leading technologies can also be found in smaller firms like JCR Pharmaceutical, a specialty pharma with clinically proven and groundbreaking technology that delivers antibodies across the highly restrictive blood-brain barrier. The company has a strong pipeline portfolio covering a wide range of rare disorders, many of which have no standard of care therapy.

Apart from antibodies, Japan has also been at the forefront of regenerative medicine. Japanese researcher, Professor Shinya Yamanaka was the first to discover that mature adult cells can be reprogrammed into embryonic-like state. These remarkable cells known as induced pluripotent stem cells (iPSCs) are now widely used in drug discovery and disease modelling, and could potentially be used as cell therapy alongside gene editing technologies.

Japan is the frontrunner in conducting iPSC therapeutic trials. Out of the 19 iPSC clinical trials worldwide, 10 were conducted in Japan, followed by 4 in the U.S and the rest in Australia, China, Iran and Germany. However, the fact that all Japanese trials are conducted entirely by academia and hospitals shows the lack of participation of pharma and biotech firms in budding transformative technologies, which is most likely due to the funding challenges faced in the biotech industry.

As of today, Japan has completed 3 iPSC transplant clinical trials which yielded positive outcomes. Despite the success, these treatments are yet to be widely adopted due to the sophisticated manual skills and precision required to grow high quality iPSCs. Hence, we think iPSC is something that is unique to Japan and would not be easily replicated outside the country.

Lately, the Japan government has shown efforts in supporting innovation through programs such as the sakigake designation system and the price maintenance premium system. Besides, a national funding body, Japan Agency for Medical Research and Development (AMED) was founded with the aim to rapidly progress medical research into treatments.

The Japanese government also announced plans on tax cut for the biotech industry to lower the hurdle for new business entrants. We strongly believe that with supportive policies, Japan’s biotech industry is fully capable to achieve a turnaround considering that they are backed by strong research resources, mostly waiting to be funded for further development.