This article reflects the opinion and analysis as well as information collated by AE Research Management Sdn Bhd, and does not constitute an investment advice or recommendation

Oil and gas prices could be well supported in the next 5+ years by a confluence of supply and demand side factors.

On the demand side, fuel consumption is quickly normalizing from the Covid19 slump. For example, American Airlines is reported to be planning to unground all its planes by May 2021. Even a more rapid adoption of electric vehicles (EVs) may not reverse the direction of fuel consumption – Exxon Mobil recently estimated that if all new cars were electric by 2025 and the world’s entire fleet were electric by 2040, liquid fuel demand in 2040 will still be at the same level as in 2013 (the last peak of oil exploration orders)!

Supply-side Crunch

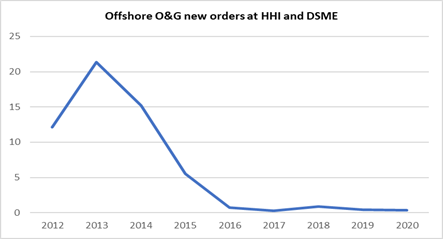

Chart 1: Prolonged slump in offshore oil & gas exploration and development

Source: Company reports (HHI and DSME)

Perhaps the most compelling argument in favor of oil prices in the coming years, is the limited supply backdrop. Exploration undertakings has dwindled. For example, orders for offshore oil and gas structures at Hyundai Heavy Industries (HHI) and Daewoo Shipbuilding & Marine Engineering (DSME), the world largest and second largest fabrication yards respectively, have peaked in 2013 and since collapsed by 95% through 2016 and remained depressed to date (see chart 1).

Reflecting similar supply-side trends, British Petroleum (BP) is reported to have downsized the number of its geologists, engineers and scientists in the hydrocarbon exploration team to less than 100 from a recent peak of 700.

Higher-than-expected long term oil prices will have numerous implications, not least being:

- intensified energy savings via electrification and inverterization of drive/powertrains;

- pricing advantage for companies with sophisticated engineering know-hows in O&G infrastructure.

Hydrocarbon is still the dominant source of electricity generation and over 60% of electricity output is consumed by motorized system. Inverterization of the motor system (using microcontrollers and power semiconductor circuitries) will reduce energy consumption significantly.

Pricing power may return to oil & gas engineering firms

With regards to (b), the number of marine yards capable of executing complex offshore O&G orders has become fewer, especially after the financial devastation from excessive competition during the previous cycle. Today, Korean marine yards are merging, Singapore’s Keppel Corporation have decided to exit the business, whilst Japanese yards are reassessing their business strategies.

It is likely that contract bidding for fabrication of complex offshore structures (drill-ships, FLNG, FPSO, oil rigs, oil platforms etc) will become rational and reflect the engineering complexity and risk involved. Based on engineering capabilities – in particular in heavy structural forging/welding – the winners should be Korean marine yards.

Before newbuild orders regain full momentum, currently suspended O&G infrastructure will be resumed. Equipment/parts upgrade and maintenance will therefore enjoy a boost, at a time when such vendors are also becoming scare.

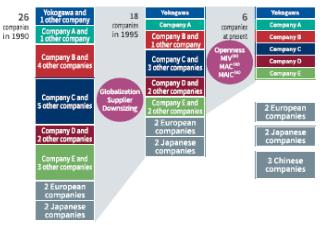

For example, the number of companies with global footprint that offer process automation and control systems, has shrunk for 26 in the early 1990s to only 6 today (see chart 2). Of the six that remain, 3 are in EU, 2 in the US and 1 in Japan. The EU players are focusing more on the electrical energy space, leaving the hydrocarbon-related business to be dominated by one Japanese and two US companies, supported by small regional firms as equipment partners.

Chart 2: Global Suppliers of Process Automation and Control Systems

Source: Yokogawa Electric

Likewise, there are only two global suppliers of large cryogenic pumps (able to operate at minus 160 degree C) for LNG infrastructure. These firms possess advanced fluid conditioning and control technologies, and their capabilities are mission-critical to the transportation of LNG in liquid form. LNG is the preferred source of hydrocarbon energy for its lighter environmental burden.