This article reflects the opinion and analysis as well as information collated by AE Research Management Sdn Bhd, and does not constitute an investment advice or recommendation.

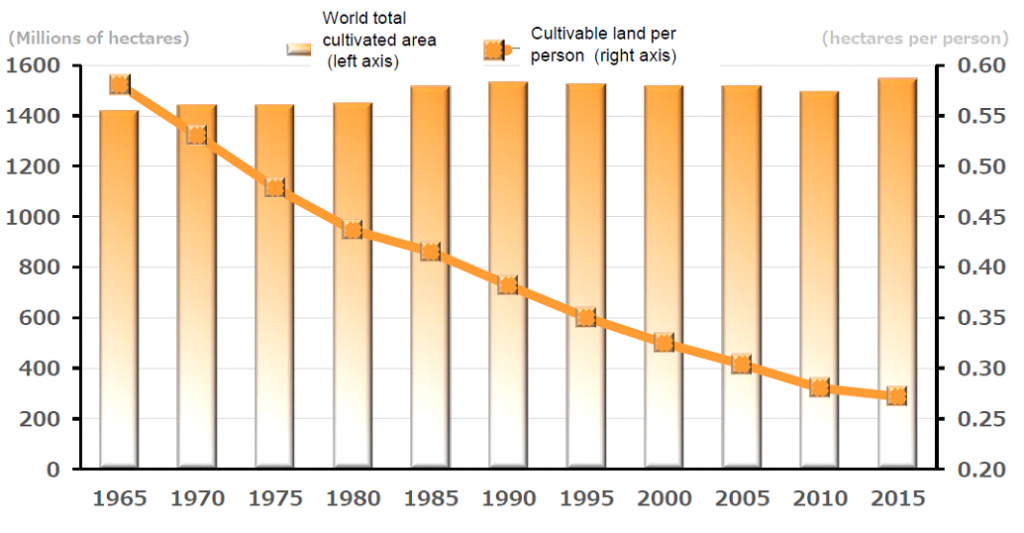

The world population continue to increase but land area cultivated has been stagnant for the past 50+ years, resulting in declining cultivated area per capita (chart 1).

This may set the backdrop for a farm supply-demand structural imbalance in the coming years. Recent trend towards plant-based proteins will also exacerbate such imbalance.

Chart 1: World Cultivated Area Has Not Increased

Growth in agriculture output from land & irrigation, fertilization and farming mechanizations has reached practical limits.

Therefore, incremental output to feed continued rise in population (especially with rising proportion of middle-class) has to be driven by:

a) novel mode of actions in crop protection, that are effective against existing chemical resistant fungi and pests;

b) plant biotech especially genomic-driven seeds and traits; and

c) precision/digital farming using geospatial positioning technologies.

Chemistry & Biotech

The pursuits of (a) & (b) fall on agro-sciences companies with very strong foundation in specialty & organic chemistry as well as in plant biology. Western firms have tended to focus their new R&D efforts on seeds & traits, while Japanese firms remain active in development of new crop protection compounds.

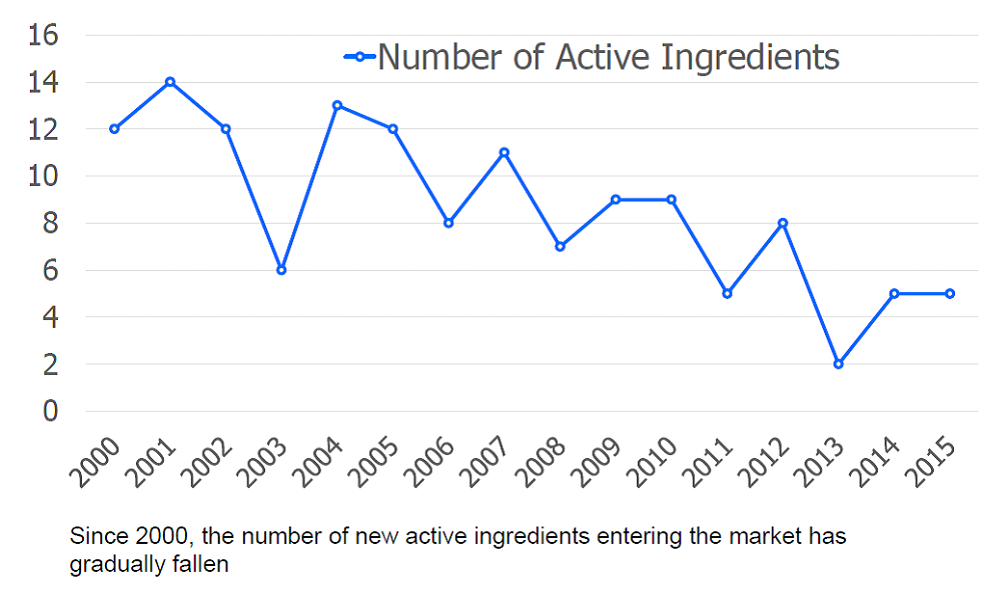

Due to the prohibitively high development cost, the number of new active crop protection chemicals entering the market has been on a decreasing trend (chart 2) in the past two decades or longer.

Scientific and regulatory complexities have raised the bar for developing new crop protection compounds and bio-engineered traits.

Chart 2: Decreased in New Active Corp Protection Ingredients Entering Market

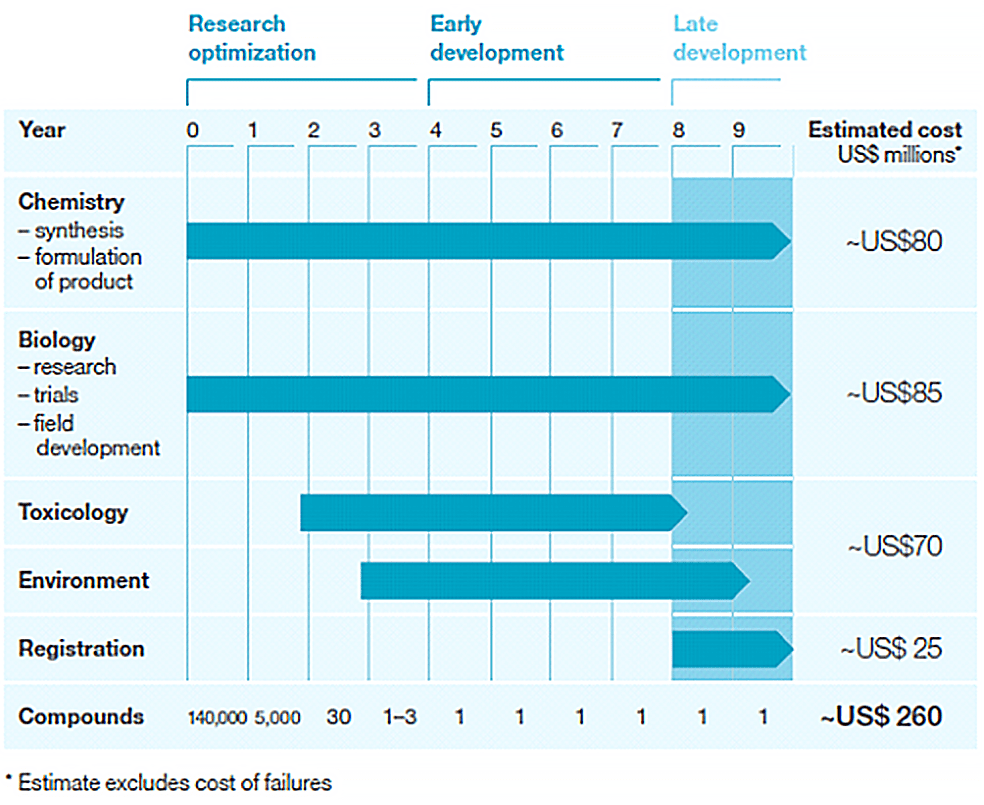

Discovery and development of a crop protection product

For example, the cost of developing a new crop protection compound is USD 260 mio (see table above), and only 1 or 2 in 100,000 candidates will succeed!

This has serious long-term consequences. Fungi and pests built up resistance once existing compounds have been used for a long time. In essence, generic off-patents products while cheaper, will continue to decline in efficacy.

Given such supply-side scenario, we believe that deep agro-sciences companies that have remained highly committed to R&D and which possess a pipeline of new crop protection chemicals, are interesting investment candidates.

Precision/Digital Farming

Another emerging trend in agriculture is precision/digital farming, to address the biggest influence on crop yield during a planting cycle – that of abiotic stresses, caused by soil and weather conditions.

Informatics – include database of historical, current and projected soil and weather distribution – across the entire farm area, with the overlay of artificial intelligence (AI) will facilitate smarter planting decisions. For example, if soil preparations, distribution of seeds, application of fertilizers/agrochemicals and harvesting can be carried out with micro precision across the entire farm area, there will be economics in input costs and higher yield outcomes.

The fundamental enabler of precision farming lies with geospatial science & engineering. Companies with such capabilities are able to introduce systems which enable farm equipment (such as tractors) to operate with speed and accuracy guided by AI-embedded positioning devices.