This article reflects the opinion and analysis as well as information collated by AE Research Management Sdn Bhd, and does not constitute an investment advice or recommendation

Over the last decade, the biopharmaceutical industry has witnessed a growing trend towards outsourcing to contract development & manufacturing organisations (CDMOs). The market is expected to grow by at least 10% p.a., driven by complex production process requirements, economies of scale and other newer dynamics.

Complex Biomanufacturing Process

Historically, the pharmaceutical industry was dominated by small molecule drugs, which are well defined chemical compounds that can be manufactured via a relatively simple chemical synthesis.

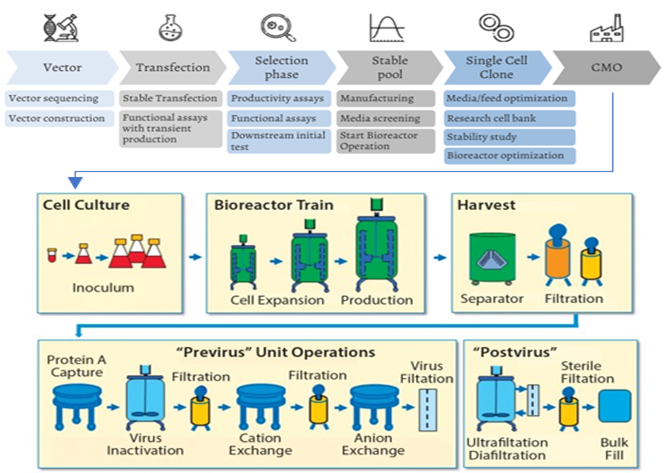

Newly emerged biologics such as antibodies, proteins and vaccines can only be manufactured in complex and robust cell culture system (see figure below), which requires superior technology and highly skilled workforce. Most importantly, biologics are extremely sensitive to its manufacturing process and materials, thus extensive cell-line development and rigorous quality control is needed to prevent structural variations that could impact drug’s efficacy and safety.

Biologics Cell Line Development to Biosynthesis

Source: Rodon Biologics; BioProcess International

Economies of scale

High biologics cost is one of the key issues in healthcare. On average, the cost of biologics is at least 20x that of small molecules, with the most expensive drug, Zolgensma priced at $2.1 million.

To keep cost low, drug makers become more inclined towards CDMO to harvest economies of scale.

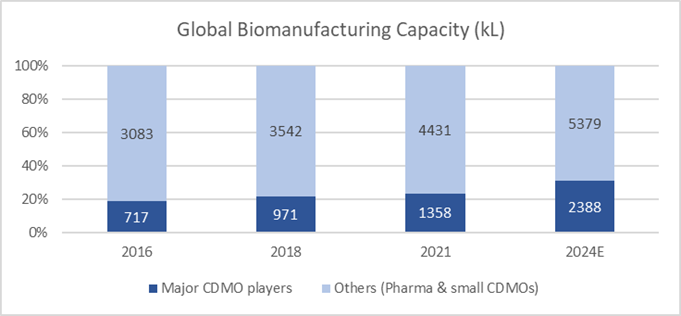

Besides greenfield expansion, bioCDMOs have also acquired existing facilities from big pharmaceutical companies in order to scale up. It is estimated that the capacity of major bioCDMO players – Lonza, Samsung Biologics, Fujifilm, Wuxi Biologics et al – will expand at a rate of 20% p.a. over the next 3 years. Fujifilm, as illustration, will reach a scale of 657 kL by 2026 from 141 kL in 2021, with a mix of large scale-up tanks (20kL each) and scale-out tanks (2kL each) to support both high and low volume drug production.

Within this rapidly growing business, there are also emerging dynamics that could shift the relative competitive strengths of major players in the coming years.

One-stop-shop

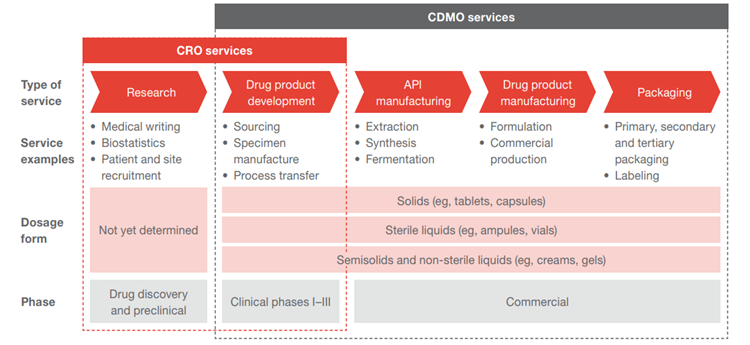

The CDMO industry has been moving towards the One-stop-shop CDMO model, offering utmost convenience to its customers by providing services from early drug development, testing, regulatory support, to commercial manufacturing, packaging, logistic, and distribution.

Source: PWC

Small biotech firms are heavily reliant on CDMOs due to resource constraints, lack of manufacturing know-hows and regulatory experiences. In such circumstances, CDMOs play a crucial role in translating research into commercial drugs, at the same time allowing clients to focus on expanding their drug pipelines.

Meanwhile, big pharmaceutical companies are redirecting their resources to focus on discovering new compounds and marketing. An increased proportion of the development and manufacturing work are being outsourced, thus driving the CDMO business.

Continuous Manufacturing

Conventionally, biologics are manufactured in batches in which manual intervention is required. This process has become inefficient as global demand for biologics grew. Drug manufacturers are racing to develop continuous biomanufacturing as an alternative in hopes of increasing biologics production, reducing human reliance, reducing process footprint and lowering costs. Similar transitions were seen in the chemical and food industry.

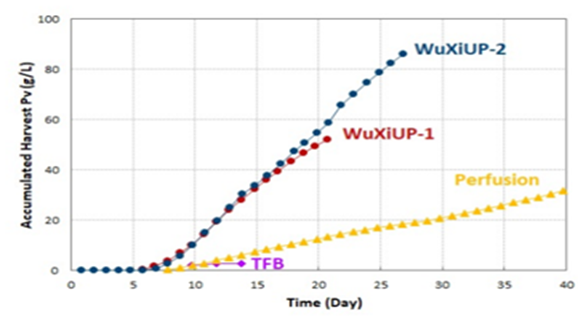

Latest breakthrough by Fujifilm has shown the ability to manufacture 30g/L in 30 days with continuous technology, as compared to 10g/L using the conventional fed-batch process. Similar results were achieved by Wuxi Biologics through their WuxiUP platform (see figure below).

However, this was performed using small 500L and 200L bioreactors. Now efforts are underway to replicate the continuous system on larger sized reactors.

Single Use Systems (SUS)

Single use (SU) bioreactors of size up to 2kL have gradually replaced stainless-steel (SS) bioreactors in preclinical and clinical manufacturing thanks to its flexibility and ease of use. These disposable SU bioreactors reduce contamination risk and shorten product changeover time from weeks to a single day, as cleaning process is no longer required.

Modular SU facilities can be built within a shorter period with less capital. Since drug regulatory approval rates are generally less than 10% (from phase 1), SU facilities allow drug makers to avoid capital intensive commitments ahead of drug approvals, thus reducing risk of economic losses.

Today, 6kL SU bioreactors are available to meet scalability needs, which could be sufficient for the majority of commercial drug production, especially if used in conjunction with continuous manufacturing processes. The strengths of SUS were highlighted during the pandemic as speed and flexibility becomes key to drug manufacturing. The global SU bioreactor market is valued at $2.2 billion in 2020 and is estimated to grow around 17% annually.

Emergence of SU coupled with continuous manufacturing technologies, may render absolute scale a less important competitive factor in bioCDMO business over time.